The disruption of the location technology landscape is set to continue as new players enter the market and companies like HERE find new homes. It is clear that access to high quality maps and location information is critical, not only to traditional players but to challengers from connected industries as well.

Additionally, the progress towards autonomous driving will require real-time availability and on-demand downloading of high definition maps quite different from navigable maps available in vehicles today. A reduction in independent, global providers of this type of information would likely see higher price points which may force companies to invest in proprietary systems, in turn slowing the development and deployment of new technologies. Ensuring availability to the automotive industry would help avoid disrupting that development.

The acquisition by Audi, BMW, and Daimler poses an interesting opportunity of how an industry collective will share a strategic resource with competitors. The most likely answer is an industry consortium supported by an initial fee, as well as an annual fee for both membership and to support ongoing costs in R&D, collection and maintenance of high definition maps in exchange for open access to the maps provided by the consortium. Those not part of the consortium are expected to pay a normal licensing fee as they would today.

The consortium model has many benefits for the industry, including the ability to combine resources to secure and continue developing a long-term strategic resource. By acquiring a global platform in HERE, it also may establish a de facto standard, giving the industry a unique opportunity to rally around specifications or processes that could in fact hasten the onset of a connected and automated future mobility ecosystem. Possibly the most important aspect is that the consortium will also own their own data, thus not having to figure out who controls customer data the service provider or the OEM.

The acquisition of HERE also impacts the mobile space significantly. HERE is one of two companies supplying navigable maps at global scale (along with TomTom) as an alternative to Google and Apple. Mobile companies?many with consumer-facing mobile clients including Facebook, Amazon, Microsoft, Baidu and Samsung?see an independent mapping solution as critical in order to compete with Google for mobile advertising dollars.

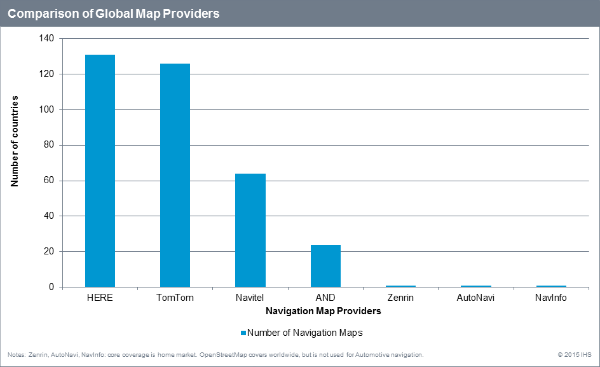

Beyond HERE, options for global map providers are limited. If HERE becomes unavailable to outside licensees, TomTom may see some significant growth opportunity as it would likely see its own licensing business pick up significantly over time. The company just reported that its Q2-2015 licensing revenue reached €38.6 million, up from €27 million in Q2-2014.

Similarly, OpenStreetMaps (OSM) could see increased interest as well because the organization has proven able to provide broad open-source map coverage, and Telenav has shown that it is possible to transition a large user base to these maps and operate a successful consumer application. However, using OSM data might put a developer at odds with its own monetization strategy because OSM relies on user contributions to stay updated and current.

The final alternative is for these mobile companies to engage regional players individually, which requires more legwork and is a clear drawback when developing global platforms.