IHS Inc., the leading global source of critical information and insight, today released updated solar photovoltaic (PV) industry forecasts from IHS analysts speaking at the SNEC 9th (2015) International Photovoltaic Power Generation Conference & Exhibition (SNEC PV Power Expo) in Shanghai. Top-line analyst presentation insights on solar demand, PV inverters, energy storage, and PV module supply include the following:

Led by China, Solar Demand Grows

IHS forecasts that global solar demand will grow up to 30 percent in 2015 compared to 2014, reaching 57 gigawatts (GW), which is 10 times the size of the solar-PV industry just seven years ago.

“For the third year running, China will be the largest end-market and the key driver of global demand in 2015,” said Ash Sharma, senior research director for IHS. The other top growth markets will be Japan, the United States, United Kingdom, and India.

“China will be the largest driver of global growth, but it also presents the largest single risk to the industry's supply-demand balance,” noted Sharma. “If the country manages to install in excess of 17 GW in 2015-which is likely-it will generate much healthier operating conditions for solar companies and a return to healthy profit margins.”

PV Inverters Return to Growth

IHS also expects the PV inverter market to return to growth. According to Cormac Gilligan, senior analyst for PV Inverters and Balance of System, revenue from PV inverter sales will increase by more than 10 percent, from $6.6 billion in 2014 to $7.5 billion in 2018. Global inverter unit shipments will also increase to nearly 70 GW of alternating current (AC) in 2018, due to strong growth in China, Japan, and emerging markets. However, pricing pressure will remain, as average global inverter prices are forecast to decrease by 9 percent each year, declining to $0.11 per watt (W) in 2018 from $0.17 per W in 2013.

Three-phase low-power inverters less than 36 kilowatts (kW) will account for the majority of revenue, garnering a 34 percent share of the market in 2018. “Low-power inverters are gaining traction in commercial- and utility-scale installations globally, particularly in China, United States, and other key markets,” said Gilligan.

Need for Energy Storage Rises

The number of newly installed energy storage systems with solar power is increasing fast. In a very optimistic scenario, with moderate policies and rapid decrease in battery prices, IHS predicts 3.6 GW of new energy storage systems will be installed in 2018, which is 15 times greater than the 231 megawatts (MW) installed in 2014. “Rising demand for electricity and increasing renewable penetration are driving a need for more energy storage,” said Isabella Ni, senior analyst for energy storage and PV demand.

Currently the biggest barrier to wide-scale deployment is the high price of batteries; however, significant cost reductions are expected for the future, and lithium-ion battery prices will fall by 40 percent over the next three years.

“Lithium-ion is currently the technology to beat, and will account for the majority of the grid-connected PV energy storage market,” said Ni.

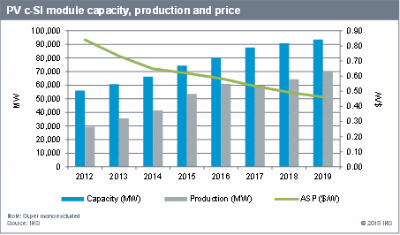

Crystalline Module Pricing Drop Slows in 2015

Global crystalline module capacity will expand significantly in 2015 and is forecast to reach to 76.6 GW; meanwhile, capacity utilization will rise, due to strong downstream demand. IHS forecasts that year-over-year crystalline module utilization will increase to 72 percent this year.

IHS expects average global prices of crystalline modules to decline just 5 percent in 2015, compared to 13 percent in 2013 and 11 percent in 2014. "Surge demand of downstream installations and high utilization rates will keep module prices from decreasing in 2015," said Jessica Jin, senior analyst for the solar supply chain.