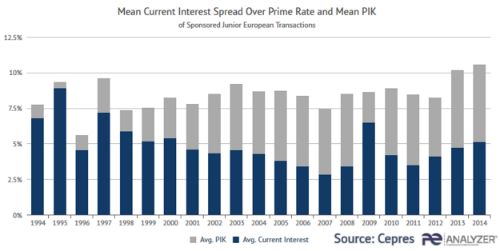

Junior private debt pricing in Europe has exceeded the US equivalent for the first time to reach an all-time high of 10.6% current interest and PIK (Payment In Kind). This confirms the increasingly attractive market opportunity in Europe. The analysis is part of the new Private Debt Tranche Report released by CEPRES today with detailed data on US and European private debt transactions.

“Private debt is now competing with buyouts as a mainstream allocation option for investors and has been previously dominated by the mature US market. Now, many US investors and credit managers are increasingly looking to Europe as a source of higher returns. The trend for pricing of junior transactions in Europe is very positive, but the contractual pricing embedded in PIK may be perceived as adding risk.” said Dr. Daniel Schmidt CEO, CEPRES GmbH “Private debt offers a diverse asset class with many advantages to investors. With a contractual coupon, it is a good hedge and delivers current income with downside protections. It can stabilize volatility for private equity investors and help lift returns for fixed income investors. With the appropriate risk/return analysis, adding private debt to a portfolio can provide an opportunity to stabilize and hedge illiquid investments.”