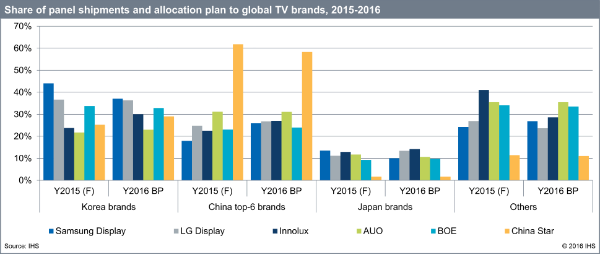

Leading global TV brands Samsung Electronics and LG Electronics, seeking to complete their product lineups, increase back-up supply and boost savings, plan to rely less on their captive panel suppliers and turn to outsourcing instead. The two South Korean TV brands made up 41 percent of the total panel shipments of Samsung Display and LG Display in 2015, down from 46 percent in 2014. The figure will decline even further to 37 percent in 2016, according to IHS Inc. (NYSE: IHS), the leading global source of critical information and insight.

“During a downturn in the business cycle, TV brands have tended to purchase panels primarily from their own captive suppliers,” said Deborah Yang, director of display supply chain research and analysis at IHS. “This year, however, TV brands are uncharacteristically lowering their reliance on internal supply and instead outsourcing more to vendors in China and Taiwan, which have become better aligned with their product lineups. The external vendors have also become more competitive in supply availability, panel pricing and quality.”

“To maintain their leading position in the TV market and better compete with other brands particularly from China, the South Korean companies will continue to take advantage of their large supply base and the extremely large scale of their businesses,” Yang said. “While lowering their reliance on captive panel suppliers, they will continue to leverage their growing Chinese panel supply base and supply of competitive panel sizes from Taiwan in 2016, in an attempt to reduce cost.”

With severely limited growth forecast for TV demand, there is an increased risk to the supply chain as well, especially for those that heavily rely on leading TV brands that now dominate purchasing and influence panel allocations and will continue to do so in 2016. “The bleak forecast is responsible for the panel oversupply, one of the critical reasons for the significant TV panel price corrections in the second half of 2015,” Yang said.

“Both TV brands and panel makers will need strategies to navigate this hazardous market landscape, succeed in increasing panel sizes, and, most importantly, survive if their capacity cannot be filled by the demand,” Yang said. “After all, industry discipline to control fab utilization is necessary to mitigate panel price declines.”